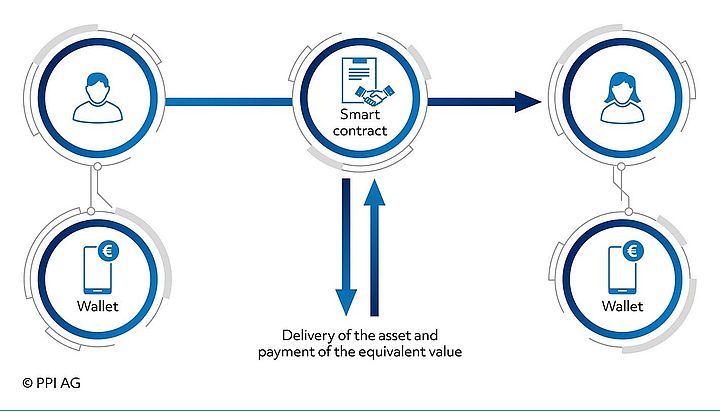

A well-functioning distributed ledger technology (DLT) offers great potential and can generate immense benefits for all participants. This way, payments networks such as SWIFT or even correspondent banking relationships can be made more secure and efficient. At the same time, the technology enables modern payment methods such as pay per use or the use of automated protocols such as smart contract.

- Open the searchbox

- Consulting ConsultingConsulting

- Consulting Consulting

- Cross-Border & High-ValueCross-Border & High-Value

- T2 (TARGET2)

- SWIFT gpi

- SWIFT MX

- Global Instant PaymentsGlobal Instant Payments

- Domestic PaymentsDomestic Payments

- Retail PaymentsRetail Payments

- Processes & IT ArchitectureProcesses & IT Architecture

- Regulatory Requirements

- Trends

- Cross-Border & High-Value

- Consulting

- Products ProductsProductsBanking SolutionsInsurance Solutions

- Products Products

- Banking Solutions Banking Solutions

- Insurance Solutions Insurance Solutions

- Products

- Technology & Operations

- About PPI About PPI

- Company Company

- Corporate GroupCorporate Group

- Corporate Social ResponsibilityCorporate Social Responsibility

- Compliance Centre

- Corporate Group

- Touchpoints

- Company

- EN