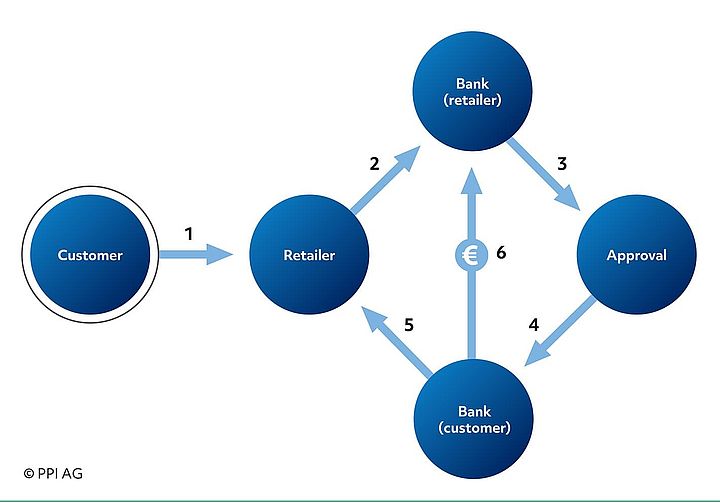

Being able to accept as many of the different and constantly evolving payment methods as possible is an essential aspect for the success of any retailer. Regardless of whether contactless, via Girocard, Apple Pay, Google Pay or PayPal: the payment should run smoothly, at best invisibly, so as not to disrupt or even interrupt the purchasing process. This is a challenge for the acquiring bank as the interface between the parties involved.

- Open the searchbox

- Consulting ConsultingConsulting

- Consulting Consulting

- Cross-Border & High-ValueCross-Border & High-Value

- T2 (TARGET2)

- SWIFT gpi

- SWIFT MX

- Global Instant PaymentsGlobal Instant Payments

- Domestic PaymentsDomestic Payments

- Retail PaymentsRetail Payments

- Processes & IT ArchitectureProcesses & IT Architecture

- Regulatory Requirements

- Trends

- Cross-Border & High-Value

- Consulting

- Products ProductsProductsBanking SolutionsInsurance Solutions

- Products Products

- Banking Solutions Banking Solutions

- Insurance Solutions Insurance Solutions

- Products

- Technology & Operations

- About PPI About PPI

- Company Company

- Corporate GroupCorporate Group

- Corporate Social ResponsibilityCorporate Social Responsibility

- Compliance Centre

- Corporate Group

- Touchpoints

- Company

- EN