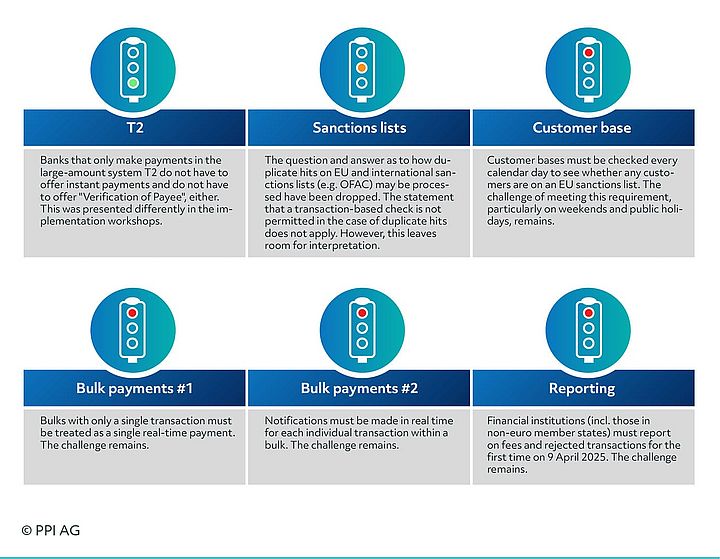

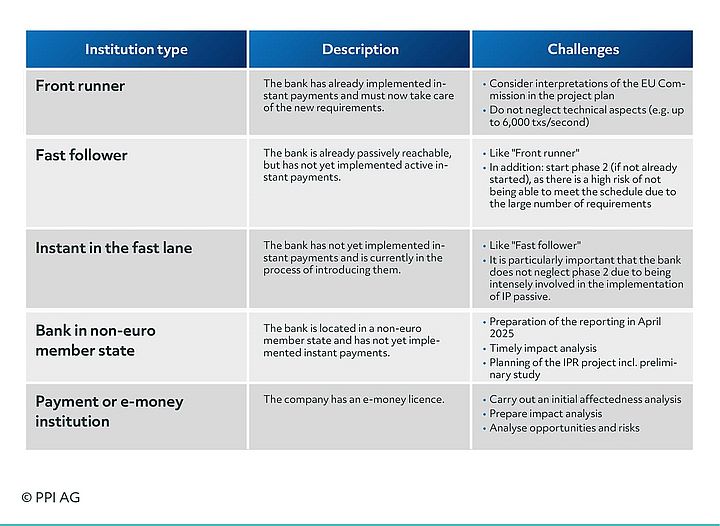

The European Union is uprooting the project plans of financial institutions. Corporate customer payments are particularly affected. Bulk payments in real time that companies submit via EBICS are to be confirmed within ten seconds – just like a normal real-time payment. EBICS files containing only a single order should be treated by the bank as if they had been submitted as a single instant payment from the outset. The requirements for sanction screening also have some pitfalls, which may mean that compliance experts have to work weekends as well. PPI has already analysed how all this affects project plans and is offering interested banks and other PSPs the opportunity to have their process model reviewed free of charge within 72 hours.

- Open the searchbox

- Consulting Consulting

Consulting

- Consulting Consulting

- Cross-Border & High-ValueCross-Border & High-Value

- T2 (TARGET2)

- SWIFT gpi

- SWIFT MX

- Global Instant PaymentsGlobal Instant Payments

- Domestic PaymentsDomestic Payments

- Retail PaymentsRetail Payments

- Processes & IT ArchitectureProcesses & IT Architecture

- Regulatory Requirements

- Trends

- Cross-Border & High-Value

- Consulting

- Products Products

Products

Banking Solutions

Insurance Solutions

- Products Products

- Banking Solutions Banking Solutions

- Insurance Solutions Insurance Solutions

- Products

- Technology & Operations

- About PPI About PPI

- Company Company

- Corporate GroupCorporate Group

- Corporate Social ResponsibilityCorporate Social Responsibility

- Compliance Centre

- Corporate Group

- Touchpoints

- Company

- EN